AI and digital finance are moving rapidly from experimentation to system-level redesign. Lloyds Banking Group’s initiative to place customer deposits on blockchain rails—paired with AI-driven processes—signals this shift. The bank expects tokenized deposits and AI to reshape how Britons buy homes, compress execution times, and eliminate intermediaries.

Lloyds’ CEO compares the potential impact to the arrival of the smartphone, forecasting a five-year window in which financial services become radically more personalised, intuitive, and automated.

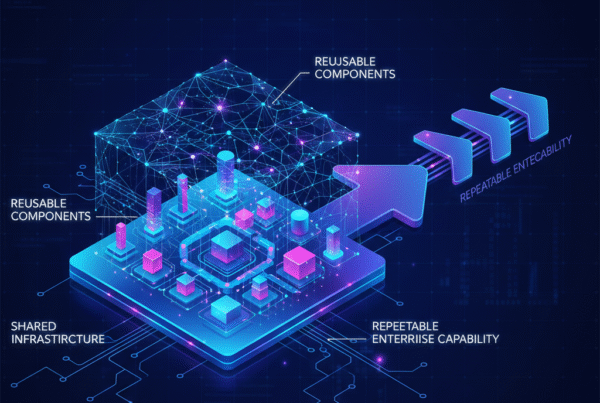

This is not incremental digitisation. It is the creation of an entirely new financial infrastructure layer, driven by the convergence of AI, tokenisation, blockchain, and smart contracts.

But while the technology frontier is accelerating, countries are not moving at the same pace.

The Global Context: Regulatory Ambition vs Technological Acceleration

The US and China: Full-Throttle Execution

The US and China are already operating at scale:

- Large language models embedded in financial workflows

- Autonomous agents deployed across research, compliance, and operations

- Private-sector experimentation enabled, not delayed

China has spent over a decade building nationwide digital payments infrastructure. The US has accelerated stablecoin regulation through the GENIUS Act, signalling clear intent: regulation should enable innovation, not stall it.

The UK: Accelerating Through System-Wide Pilots

The UK sits between acceleration and caution. Lloyds’ nationwide pilot of tokenised deposits proves the country can run system-level experiments. The ambition is explicit:

- Smart-contract-driven mortgages

- Streamlined value exchange

- AI-embedded customer guidance

This is a serious attempt to modernise financial rails at scale.

Europe: Still on the Starting Grid

Europe, by contrast, is still preparing to run.

While the US and China are racing—and the UK is accelerating—the EU is fastening seatbelts and checking compliance. Frameworks such as MiCA, the EU AI Act, and cross-border harmonisation aim to maximise safety, but often at the cost of speed.

There is a growing risk that by the time Europe is technically ready, the race will already be decided.

Our View: The Bottleneck Is Regulatory Drag, Not Technology

From deploying AI across asset managers in the UK, Luxembourg, and Switzerland, one conclusion is clear:

Europe does not lack capability.

European firms have:

- World-class quant teams

- Deep regulatory and compliance expertise

- Strong digital-transformation budgets

The constraint is structural.

European regulation requires firms to solve governance before deployment. The US and China solve governance during deployment. That single difference creates a massive velocity gap.

Even when firms understand the value of agentic AI—automated research, compliance checks, workflow routing—production timelines stretch due to overlapping supervisory requirements:

- Explainability

- Auditability

- Human-in-the-loop controls

- Cross-border data restrictions

What’s often overlooked is that delay carries a compounding cost. AI benefits scale non-linearly. Once one workflow accelerates, every connected workflow accelerates. The US and China are already stacking these gains.

Europe risks falling behind exponentially, not incrementally.

What Europe’s Asset Managers Must Do Now

1. Build AI Governance and Infrastructure Early

Waiting for full regulatory clarity is the slowest strategy.

Firms should pre-build:

- Governance frameworks

- Model validation and monitoring layers

- Auditability and traceability systems

This ensures deployment can happen immediately once approvals are granted.

2. Prioritise Interconnected Automation

AI must be deployed as linked systems, not isolated tools.

Focus on:

- Research → risk → compliance → reporting workflows

- Agentic AI that compounds value across the lifecycle

Isolated productivity gains will not close the global gap.

3. Engage Regulators Proactively

Regulation is evolving—but unevenly.

Firms that actively shape supervisory conversations will achieve operational clarity faster than those that wait passively for guidance.

4. Prepare for Tokenisation + AI Convergence

Lloyds’ pilot is not an outlier—it is a preview.

The next infrastructure layer will include:

- Tokenised deposits and funds

- AI-driven smart-contract workflows

- Machine-led settlement and reconciliation

European asset managers must build literacy and readiness now—not after MiCA extensions arrive.

Conclusion: Europe Must Stop Preparing and Start Running

The future of AI in asset management will not be won by the best models—it will be won by the fastest adoption cycles.

- The US and China are already at full speed

- The UK is accelerating through system-wide pilots

- Europe is still adjusting equipment on the starting line

If Europe does not shift from regulation-first to deployment-with-governance, it risks entering the race after the podium is already full.

The next five years will decide whether European financial institutions remain globally competitive—or become slow-moving observers in an AI-driven financial system.