What is the expectations gap in financial services AI?

The expectations gap in financial services AI is the difference between how important firms believe AI is and how much measurable impact they have achieved in practice.

According to MSCI research, 68% of wealth managers view AI as moderately to very important, yet only 27% believe their segment is leading in adoption. This gap reflects a broader tension between optimistic technology forecasts and slower enterprise-level implementation.

Why does AI adoption feel slow in asset management?

AI adoption in asset management feels slow because institutional complexity, regulation, and governance requirements delay visible outcomes.

Unlike consumer AI, investment management requires:

- Compliance validation

- Model risk management

- Data lineage and auditability

- Client-specific constraints

AI cannot scale without changes to operating models and workflows. As with past general-purpose technologies, productivity gains appear only after institutions reorganize around the technology.

How do business models affect AI adoption in financial services?

Different financial services segments adopt AI for different goals:

- Wealth managers focus on scale, personalization, and client engagement

- Asset managers and hedge funds focus on research velocity, proprietary data, and investment insight

Because objectives differ, adoption curves differ. Comparing AI progress across segments creates misleading conclusions about who is “ahead.”

Is slow AI progress a sign of conservatism?

Slow AI progress is not primarily conservatism. It reflects the J-curve effect seen with general-purpose technologies.

Early AI adoption often introduces friction and inefficiency. Productivity gains emerge later, once workflows, governance, and supporting systems mature. Both technologists and economists capture part of the truth, but neither explains enterprise reality alone.

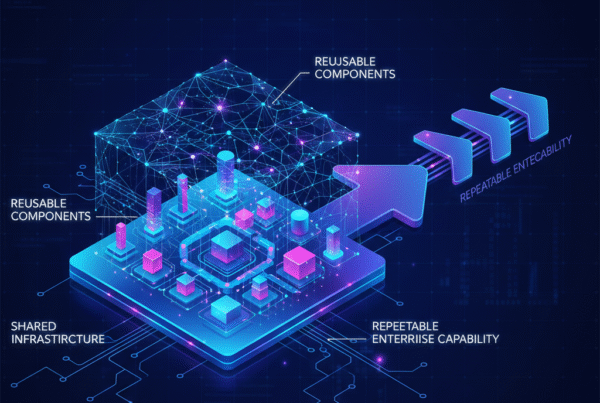

How does AI create real value in asset management?

AI creates real value in asset management when it accelerates connected workflows, not isolated tasks.

If AI speeds up research but compliance and reporting remain manual, the bottleneck persists. When AI augments research, compliance, portfolio construction, monitoring, and reporting together, the entire investment cycle compresses.

This is where agentic AI for asset managers delivers advantage: coordinated agents that share context, enforce controls, and reduce end-to-end decision time.

What are the key priorities for leaders adopting AI in asset management?

1. Measure AI against your business model

Wealth managers should measure AI by client growth and personalization quality. Asset managers should measure AI by research coverage, velocity, and risk oversight.

2. Build governance before scale

AI governance for asset managers in Europe must precede broad deployment. Data provenance, explainability, and permissioning determine how far AI agents can operate.

3. Connect workflows, not tools

Deploy autonomous AI agents to link proposal drafting, suitability checks, portfolio monitoring, and reporting. Value compounds only when handoffs disappear.

4. Balance build vs. buy

Alpha-focused firms may need proprietary models and datasets. Client-focused firms can begin with third-party tools. Both approaches should converge on integrated platforms.

5. Reset expectations with stakeholders

Boards should expect modest early returns followed by faster gains once complementary investments mature.

What will define the next phase of AI in asset management?

The next phase of AI in asset management will be defined by systems of AI agents, not individual models.

Competitive advantage will come from firms that embed AI into end-to-end investment and client workflows, aligning technology with core competencies such as alpha generation or personalized advice.

Conclusion: Why the AI expectations gap will eventually close

AI adoption in asset management will progress more slowly than the boldest technology forecasts because fiduciary environments demand rigor and control.

However, impact will ultimately exceed conservative productivity models because acceleration compounds across connected processes.

Firms that design for long-term compounding—while executing with discipline—will move from pilots to systemic advantage and close the AI expectations gap sustainably.