Beyond the Hype: Rethinking What AI Means for Finance

When economists and technologists debate the economic impact of artificial intelligence, they often miss a crucial truth about finance: transformation doesn’t happen in theory—it happens in systems.

The Financial Times recently highlighted this tension, contrasting the cautious skepticism of economists with the boundless optimism of AI evangelists. One side warns that productivity gains take time; the other predicts exponential progress. Both may be right—but for financial institutions, the real story lies elsewhere.

From our vantage point working with asset managers and enterprise firms deploying AI every day, we see that the determining factor in AI’s economic impact is neither scale nor intelligence alone—it’s speed: the speed of adoption, of integration, and most importantly, of interaction between systems.

The Opportunity — AI as a Force Multiplier in Financial Systems

The FT article underscores a critical divide: economists argue that AI’s productivity effects will unfold gradually, much like previous general-purpose technologies such as electricity or the internet. Technologists, by contrast, envision AI as a singularity-level breakthrough—automating not only human labor but human thought itself.

In finance, this debate manifests acutely. On one hand, firms are already using AI for credit scoring, fraud detection, and portfolio optimization. On the other, truly systemic transformation—where decision-making itself becomes algorithmically enhanced—remains nascent.

As the Stanford Digital Economy Lab’s Erik Brynjolfsson noted, the biggest productivity gains don’t come from the technology itself but from complementary investments—redesigning workflows, retraining teams, and re-architecting systems. Financial institutions are no exception.

For asset managers, this means AI won’t deliver its promised 10x improvement simply by deploying models. The value will come from integrating those models across interdependent processes—research, execution, compliance, and client engagement—so that acceleration in one domain amplifies performance in the next.

Our Perspective — Why Enterprise AI Adoption Is Slower (and Smarter) Than You Think

From our work embedding AI within asset management and financial institutions, we’ve seen firsthand that adoption in the enterprise world is fundamentally different from the consumer landscape technologists often reference.

Consumers can adopt new technologies in seconds—a download, a click, an update. Enterprises, by contrast, must navigate legacy systems, data silos, regulatory oversight, and cultural inertia. Integration isn’t just about installing software; it’s about orchestrating transformation across people, processes, and platforms.

This structural complexity means that AI adoption in finance will unfold more slowly than most technologists imagine—but also more securely and sustainably than many investors anticipate. In fact, this longer runway may be an advantage. Firms that invest methodically in data governance, change management, and interoperability will build durable competitive moats that fast followers cannot easily replicate.

The second—and perhaps more profound—insight we emphasize is that speed itself compounds value. Speed isn’t merely a byproduct of AI; it’s a performance multiplier.

Think of two analysts whose workflows are partially automated. Each experiences productivity gains. But when their processes are interlinked—say, one generates signals and the other executes strategies—the acceleration of both yields nonlinear returns. You don’t just save time; you shorten the decision cycle, amplify responsiveness, and unlock new compounding advantages.

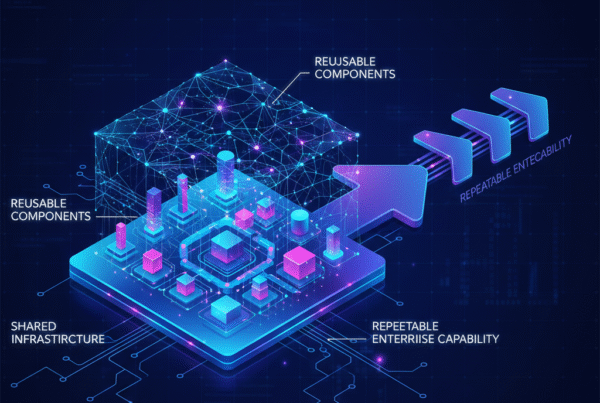

In enterprise AI, this is where the real frontier lies: interconnected acceleration—the idea that when systems and people accelerate together, the sum of their gains exceeds the individual parts.

Novel Insights — The Compounding Power of Speed in Finance

If economists are right that AI’s economic gains require complementary investments, and technologists are right that AI can multiply output at scale, then the synthesis is clear:

The future of AI-driven finance will belong to firms that can compound speed—turning faster processes into faster learning, faster innovation, and faster growth.

We call this phenomenon the velocity premium.

In markets defined by microseconds and margin pressure, velocity has always been valuable. But AI is redefining what velocity means: it’s no longer just about execution speed—it’s about the rate at which organizations can absorb information, make decisions, and adapt.

Consider portfolio optimization. Traditional models might rebalance monthly or quarterly; AI-driven systems can reassess continuously. But when portfolio construction, risk modeling, and trade execution are all accelerated in sync, you don’t just react faster—you create a new temporal advantage that compounds over time.

That’s why the firms that view AI as an isolated efficiency tool risk missing the broader transformation. The real opportunity lies in designing for systemic acceleration—building architectures where each AI-enabled process amplifies the performance of the others.

Building AI Advantage Through Intelligent Speed

The debate between economists and technologists misses a critical nuance: AI’s economic value in finance won’t hinge on whether machines outthink humans or on when productivity spikes show up in GDP data. It will hinge on how effectively institutions learn to connect and accelerate the moving parts of their operations.

The firms that win the AI race won’t necessarily be the first to adopt; they’ll be the ones that understand how to make speed compound—where each incremental improvement amplifies the next.

As we see it, the real AI revolution in finance won’t come from singular breakthroughs or sudden shifts in productivity metrics. It will come quietly, from within—through the deliberate acceleration of interconnected systems that make financial organizations smarter, faster, and exponentially more adaptive.

Because in the age of AI, speed isn’t just an advantage—it’s the new form of intelligence.