- 1) What is AI in fintech, and how does it work?AI in fintech refers to using artificial intelligence in financial tasks, utilising algorithms and machine learning to process data and improve efficiency.

- 2) How does AI contribute to the security of financial transactions?AI detects anomalies and potential fraud, enhancing security by identifying and minimising risks in financial transactions.

- 3) How does AI personalise financial products and services for customers?AI analyses customer data and behaviours to recommend tailored financial solutions, enhancing customer satisfaction and engagement.

- 4) What are the key benefits of AI in risk management within the fintech industry?AI aids in risk management by analysing data and market trends, providing insights for better decision-making and risk mitigation.

- 5) How does AI contribute to customer service improvement in fintech?AI automates processes, provides faster responses, and identifies cross-selling opportunities, leading to improved customer satisfaction and retention.

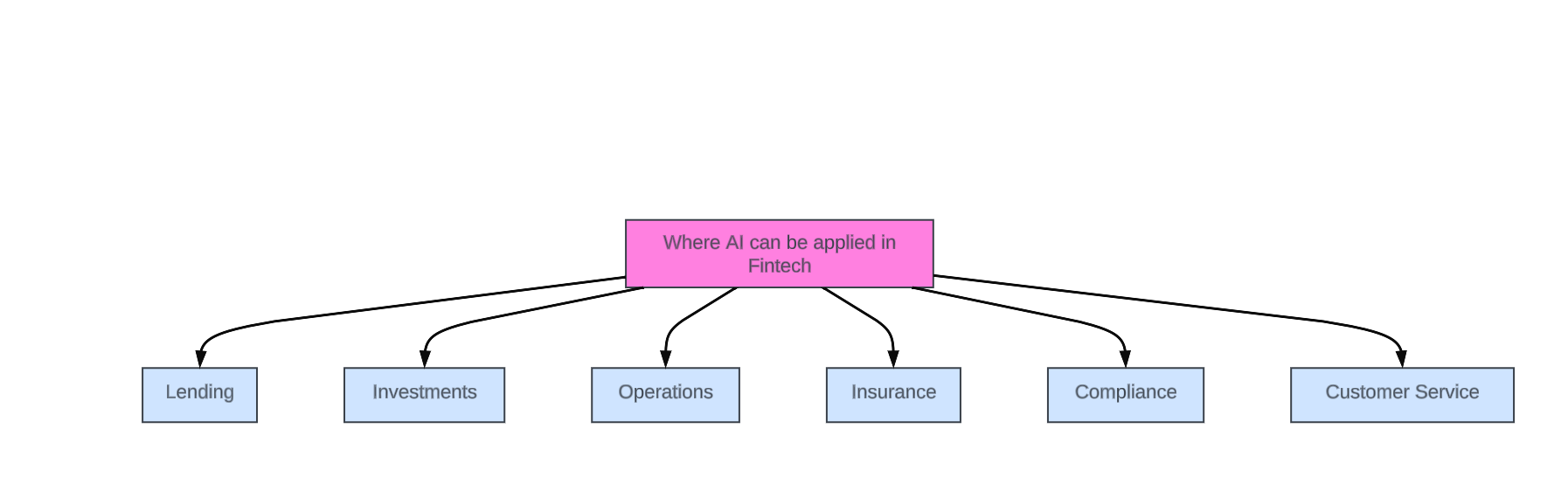

Applications of AI in Fintech

The applications of AI in Fintech are numerous. Let's dive into six different benefits....

From algorithms that anticipate market changes to chatbots improving customer service, AI is not just a future concept — it’s actively changing our financial landscape today. Let’s dive into six ways AI can be applied to fintech.

AI in fintech: market overview

The global arena of AI integrated within fintech is burgeoning, with forecasts indicating a leap to $305.7 billion by year-end

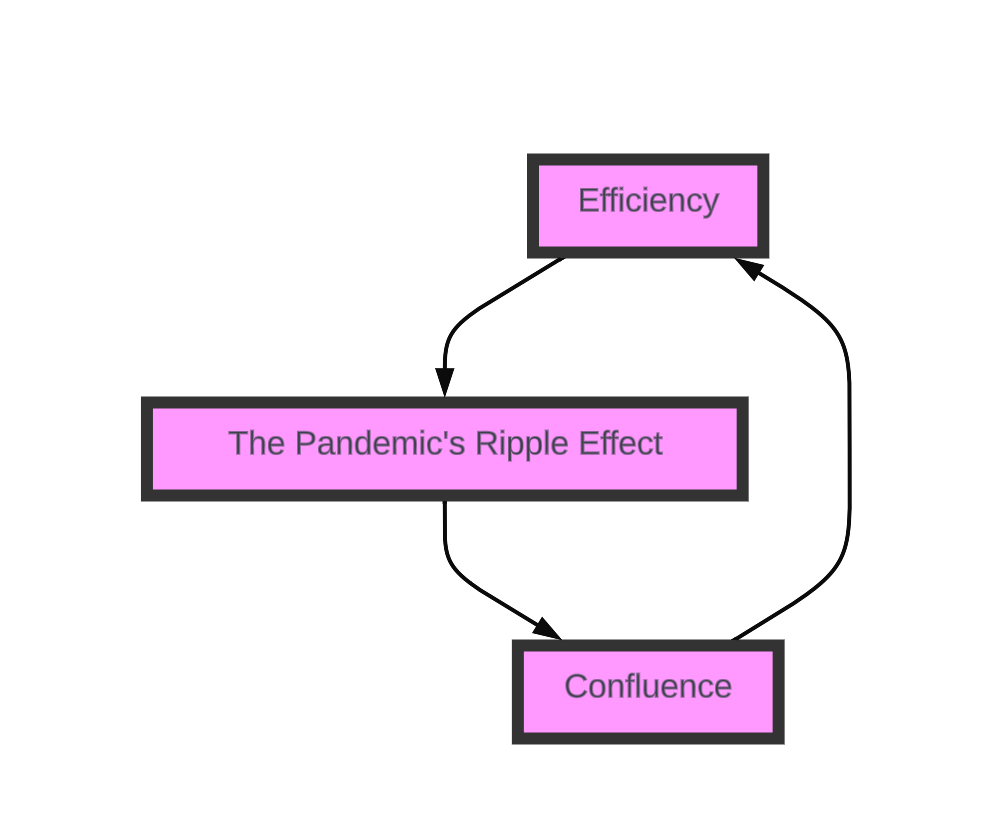

Such a remarkable estimate is propelled by multiple elements:

The Efficiency of AI in Fintech:

The incorporation of AI within fintech realms significantly elevates productivity levels. Ranging from refined accuracy in credit score monitoring to a reduction in the hours poured into data management, the merits brought forth by artificial intelligence are substantial, naturally encouraging a broader acceptance.

The Pandemic’s Ripple Effect:

The profound alteration in work culture triggered by COVID-19, coupled with the ensuing governmental measures, has further accelerated the uptake of avant-garde technologies across various sectors. Companies employing AI tools witnessed an uptick in their productivity even amidst the lockdown scenarios.

Confluence:

There’s an emerging confluence of fintech with other analogous sectors like Regulatory Technology (Regtech) and Insurance Technology (Insurtech). The infusion of AI augments the utility of interdisciplinary software solutions. Moreover, the regulatory environment is also becoming more conducive.

Many governments and international bodies are now laying down frameworks and guidelines that are fostering a friendly ecosystem for fintech innovations. This, coupled with the growing investment in blockchain technology, is creating a fertile ground for developing robust and compliant fintech applications.

The convergence of these factors leads to an unambiguous inference: the present moment is opportune for venturing into fintech application development.

Benefits of AI in Fintech

- Speed: AI streamlines financial operations, reducing manual tasks and enhancing process efficiency, crucial for tasks like financial transactions

- Security: With fraud costing dearly, AI’s role in fraud prevention is invaluable, offering robust detection mechanisms to curb financial fraud

- Personalisation: Tailoring financial products to individual needs is a forte of AI, driving customer satisfaction and engagement to new heights

- Risk Management: AI’s prowess in superior forecasting aids in better risk assessment, enabling sound credit decisions and risk mitigation.

- Innovation: The fusion of fintech with AI sparks innovative solutions, opening doors to new services and products, and blending fintech with other tech-driven sectors like Regtech and Insurtech.

- Insight: AI’s data analysis capabilities provide deeper insights into market trends and customer behaviours, aiding in informed decision-making.

Top Applications of AI in fintech

Lending

About 28% of the top 50 financial tech companies work in lending. AI is making major waves across the spectrum of lending activities:

-

Retail Lending Operations

AI algorithms can automate the evaluation process of credit applicants by capturing and analysing document data. Rather than manually reviewing payslips, invoices, and other financial documents, AI can handle lending operations with minimal human involvement. This enables banks and financial institutions to process credit applications swiftly and with fewer errors.

-

Commercial Lending Operations

Financial organisations can extract relevant data from cash flow statements and other financial documents of borrower companies. This data allows for faster lending services and more accurate credit evaluation.

-

Retail Credit Scoring

AI tools leverage predictive models to examine the credit scores of applicants, minimising regulatory expenses and compliance while improving decision-making.

-

Commercial Credit Scoring

AI can analyse financial information and provide insights on financials using techniques like machine learning. This eliminates the need for labour-intensive calculations and allows for better commercial loan decisions.

One notable example of AI application in lending is Lenddo, a startup established in 2011. Lenddo focuses on emerging markets where the middle class often lacks conventional credit histories or bank accounts.

By leveraging advanced machine learning, Lenddo analyses unconventional data such as social and psychometric data, as well as online behaviour, to predict an individual’s creditworthiness. This data is converted into a credit score that can be utilised by banks and lenders, enabling financial inclusion for millions of people.

Investments

-

Robo-Advisory

Robo-advisory is a prominent application of AI in fintech, that seamlessly combines technology with personal finance management. Through the utilisation of virtual assistants and AI chatbots, individuals can effortlessly monitor their finances, gaining valuable insights on spending habits, targeted savings, and investment portfolios tailored specifically to their risk appetite and investment experience.

-

Algorithmic Trading

AI algorithms can execute trades automatically based on predefined parameters and market conditions. High-frequency trading relies on AI-powered systems that can rapidly analyse market data and execute trades in real-time, capitalising on small price discrepancies. AI in algorithmic trading enhances efficiency, speed, and accuracy, potentially improving trading performance.

-

Risk Assessment

AI models can analyse historical market data and other relevant information to assess investment risks. By identifying patterns and correlations, AI systems can provide risk scores for different assets or investment portfolios, helping investors make informed decisions based on their risk tolerance.

Operations

-

Debt Collection

Debt Collection processes have significantly benefited from the integration of AI in fintech. AI can resolve delinquency issues and provide efficient debt-collection procedures for banks and financial institutions. TrueAccord, established in 2013, is an example of an AI-driven debt collection platform. It utilises machine learning to create personalised digital interactive experiences for debtors, significantly improving the debt collection process.

-

Procure-to-Pay

Financial institutions can introduce AI-powered invoice capture technology to automate invoice systems, streamline processes, reduce manual errors, and improve loan recovery ratios.

-

Account Reconciliation in Commercial Banking

AI can extract and compare data from bank statements, expediting the account reconciliation process and eliminating errors.

Insurance

-

Insurance Pricing

AI assesses the risk profiles of consumers to determine suitable insurance prices, reducing costs, streamlining workflows, and enhancing customer satisfaction.

-

Claims Processing

AI can handle multiple tasks involved in claims processing, such as review, adjustment, investigation, and remittance. It facilitates efficient document processing, detects fraudulent claims, and ensures compliance with regulations. Companies like Tractable utilise AI systems to detect accident images and estimate repair expenses, significantly accelerating claims processing.

Audit & Compliance

-

Fraud Detection

AI technologies play a crucial role in detecting and managing cybersecurity threats and data breaches. They can also enhance general regulatory compliance by reducing exposure to fraudulent documents and minimising operational expenses. American Express, for example, utilises fraud algorithms optimized with NVIDIA TensorRT to monitor transactions in real-time and detect fraud swiftly.

-

Regulatory Compliance

AI-powered Natural Language Processing (NLP) technology can scan regulatory and legal documents to identify compliance issues swiftly and cost-effectively, without manual involvement.

-

Travel & Expense Management

AI, with deep learning algorithms and document capture technologies, can prevent non-compliant spending, minimise approval workflows, and mitigate compliance risks related to fraud and payroll taxation.

Customer Service

-

Know Your Customers (KYC) Processes

AI, particularly NLP, enables banks to detect irregular patterns and identify risk areas in KYC processes without human intervention. Human interaction is reserved for extreme cases, resulting in fewer errors, enhanced security and compliance, and faster processing.

-

Responding to Customer Requests

Conversational AI systems can address customer requests promptly, with human intervention required only for unresolved issues. This allows call centre workers to focus on more complex requests. Square, a digital payments fintech company, employs conversational AI to handle 75% of consumer queries, reducing no-show appointments with the sales team.

-

Identification of Upsell & Cross-sell Opportunities

AI technologies and CRM systems help financial institutions identify untapped upsell and cross-sell opportunities. By analysing customer behaviours, banks can enhance revenues and customer satisfaction. For example, a platform can suggest car insurance to a customer in the process of purchasing a car.

-

Customer Churn Prediction

One of the commits common applications of AI in fintech is churn prediction. AI models analyse consumer behaviour patterns and predict churn probabilities. This enables financial institutions to understand why a customer is at risk of churning and take appropriate actions to prevent it.

Final Thoughts about AI in Fintech

AI in Fintech is a growing field. Whether lending, investments, operations, insurance, audit and compliance, or customer service, AI has made things faster, easier, and more customer-friendly. The possibilities for AI in fintech are endless, promising a future where banking and investing are smarter and more user-friendly than ever. Financial institutions need to jump on the AI bandwagon to stay ahead and meet the needs of customers in today’s digital world.

Author: Johanna Walsh